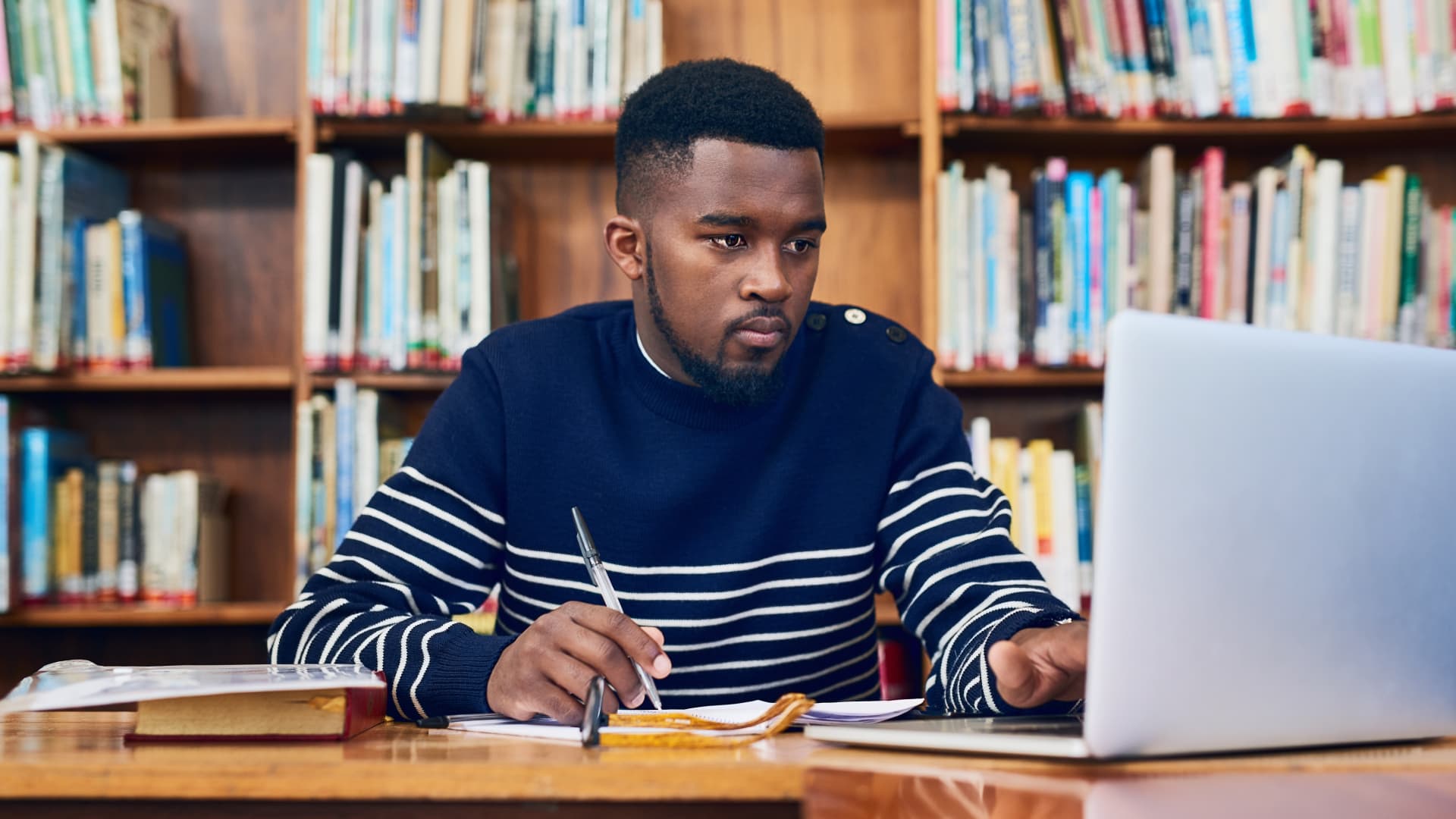

The way we make payments has changed dramatically in a time when technology has advanced rapidly. Traditional payment methods have been augmented and, in some cases, even supplanted with cutting-edge substitutes as e-commerce and online transactions have grown in popularity. The introduction of virtual credit cards is one such paradigm-shifting invention that is poised to completely change how we make online payments.

Digital copies of actual credit cards are referred to as virtual credit cards, virtual payment cards, or digital credit cards. They offer customers a safe and practical means to conduct online transactions because they are created expressly for online use. Virtual credit cards only exist in the digital space and may be used with a variety of gadgets, including smartphones, tablets, and laptops, in contrast to regular credit cards, which are physical pieces of plastic.

What distinguishes virtual credit cards from regular credit cards, and why should you use one? Let’s examine some of the main benefits they provide:

Increased Security Security is one of the main worries when it comes to online transactions. This issue is addressed by virtual credit cards, which add another level of security. Virtual cards lessen the possibility of card theft or cloning because they are not physically present. In order to reduce the likelihood of fraud, virtual credit cards can also be created for one-time use or for particular retailers. Users are given piece of mind thanks to this improved security feature, which makes it easier for them to shop online.

Privacy Protection:

Compared to traditional credit cards, virtual credit cards provide an unequaled level of privacy. Your personal information and credit card information are not disclosed to the retailer when you make a purchase using a virtual card. Instead, each transaction generates a different, temporary card number. Your identity and financial details are safeguarded by this, protecting your sensitive data from potential breaches or misuse.

Convenience and Flexibility:

Online buyers benefit greatly from the convenience and flexibility offered by virtual credit cards. Users can create a virtual credit card with a set spending cap, expiration date, or transaction duration with just a few clicks. With this degree of flexibility, you may modify your online payment method to meet your unique requirements and keep control of your financial activities. You can make purchases from anywhere at any time with virtual credit cards that are simple to access through mobile applications or secure web platforms.

Effortless Integration:

Virtual credit cards easily interface with already-used e-wallets and payment systems, significantly streamlining the online payment process. They can be connected to well-known digital wallets like PayPal or Apple Pay, enabling quick and simple purchases. The addition of virtual credit cards to these platforms improves the user experience overall and expands the range of available online payment methods.

Tracking and budgeting: The ability to efficiently track and manage your expenditure is another noteworthy advantage of virtual credit cards. You may easily keep track of your online purchases and control your spending by creating distinct virtual cards for various uses or merchants. With the help of this function, consumers are better able to keep track of their spending patterns, establish spending caps, and make wise choices while making purchases online.

Many financial institutions and payment service providers are embracing this new type of online payment as virtual credit cards become more and more well-liked. They provide a variety of features and advantages suited to the requirements of both people and organizations. Virtual credit cards offer a practical option for anyone who worries about online security, whether they are a frequent online shopper, a small business owner, or both.

Virtual Credit Cards Are Made Especially For Online Purchases

While virtual credit cards have many benefits, it’s vital to remember that they cannot always replace physical credit cards. Virtual credit cards are made especially for online purchases; they might not be accepted everywhere or for all offline purchases. Before using virtual credit cards as your principal payment option, it is crucial to evaluate your unique needs and preferences.

The future of internet payments is virtual credit cards, which offer improved security, privacy protection, ease, and flexibility. Virtual credit cards provide an appealing alternative for consumers and organizations in the digital era because to their smooth integration into already-existing payment platforms and their capacity to track and manage spending effectively.

The demand for safe and practical online payment options is on the rise as e-commerce’s popularity soars. By utilizing cutting-edge technology, virtual credit cards meet these criteria and guarantee the security of your financial transactions. Virtual credit cards offer consumers peace of mind by eliminating the dangers of physical card theft or cloning, allowing them to explore and enjoy the plethora of options available in the internet marketplace.

Another important benefit of virtual credit cards is the privacy protection they provide. Protecting personal information is crucial due to the rising frequency of data breaches and identity theft. Your sensitive data is protected from internet retailers by virtual credit cards, lowering the possibility of it getting into the wrong hands. Virtual credit cards safeguard your identity and financial information by creating distinct card numbers for each transaction, protecting your privacy in a world that is becoming more connected.

Simplicity And Flexibility

For contemporary consumers, virtual credit cards are a desirable option due to their simplicity and flexibility. Users have extensive control over their online purchases because to the ability to design cards with precise spending caps, expiration dates, or transaction lengths. People may efficiently manage their budgets and choose wisely when they shop online thanks to this freedom. Additionally, transactions may be carried out without any problems, whenever and wherever, thanks to the availability of virtual credit cards through mobile applications and web platforms.

The advantages of virtual credit cards are amplified further by integration with already-existing payment platforms and e-wallets. Users can benefit from a faster payment process by connecting virtual cards to well-known digital wallets. The integration makes transactions quick and simple, removing the need for manual card data entry and lowering the possibility of mistakes. The whole user experience is improved by the coherent and unified payment ecosystem that is provided by this degree of integration.

Are Incredibly Useful For Tracking And Budgeting

Virtual credit cards are incredibly useful for tracking and budgeting. Users can easily manage their spending and keep track of their expenses by creating several cards for various uses or retailers. With the help of this function, users may better understand their spending patterns, establish spending caps, and choose wisely while making online purchases. Virtual credit cards’ transparency and control enable appropriate financial management in the digital sphere.

Virtual credit cards are positioned to have a substantial impact on how internet payments are regulated in the future. They provide a tempting alternative to conventional credit cards for online transactions thanks to their strong security measures, privacy protection, ease, and integration possibilities. Before completely embracing virtual credit cards as a principal payment option, it is crucial to take into account each person’s demands and whether they are accepted in particular situations.

Conclusion

Finally, virtual credit cards are a major advancement in the world of online payments. They are an appealing option for the modern digital consumer because of their capacity to improve security, safeguard privacy, offer ease and flexibility, easily interact with existing platforms, and enable efficient tracking and budgeting. Virtual credit cards are poised to transform how we conduct online transactions as technology advances, creating new opportunities and ensuring a safe and easy payment process for everybody.